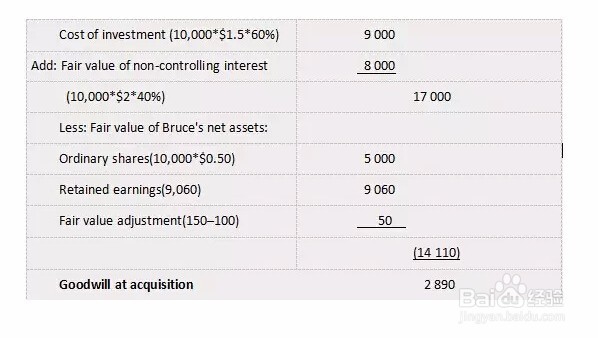

1、(1)Wallace purchased its 60% of Bruce'挢旗扦渌;s 10 million $0.50 nominal value ordinary shares on 1 February 20X8 for $1.50 per share. The market value of the shares at this date was $2.(2)At 1 February 20X8 the retained earnings of Bruce were $9,060,000.(3)The fair value of the non-controlling interest in Bruce was determined using the market value share price. The book value of Bruce’s land was $100,000 at fair value of $150,000

2、就是这么简单的,学会了么